QuickBooks PayPal Integration: A Comprehensive Guide

Managing PayPal transactions within QuickBooks Online can quickly become a daunting task for business owners, accountants, and bookkeepers. Each sale, fee, refund, and expense must be recorded with precision, which often results in labour-intensive manual work and the risk of errors. By integrating PayPal with QuickBooks Online through PayTraQer, this challenge is resolved as it automates the entire process. PayTraQer directly syncs all your PayPal transactions into QuickBooks Online in real time, ensuring precise bookkeeping and easy reconciliation. This blog will take you through the complete process of integrating PayPal with QuickBooks Online using PayTraQer and discuss why it is the best option for automation.

This blog is ideal for small business owners, accountants, and bookkeepers who utilize PayPal and QuickBooks Online for payment management. It is designed for anyone looking for automated, error-free transaction syncing with PayTraQer.

Contents

How to Integrate PayPal with QuickBooks Online using PayTraQer (Step-by-Step Guide)

Why PayTraQer is the Best Choice for PayPal–QuickBooks Integration

Wrap Up

Frequently Asked Questions

How to Integrate PayPal with QuickBooks Online using PayTraQer (Step-by-Step Guide)

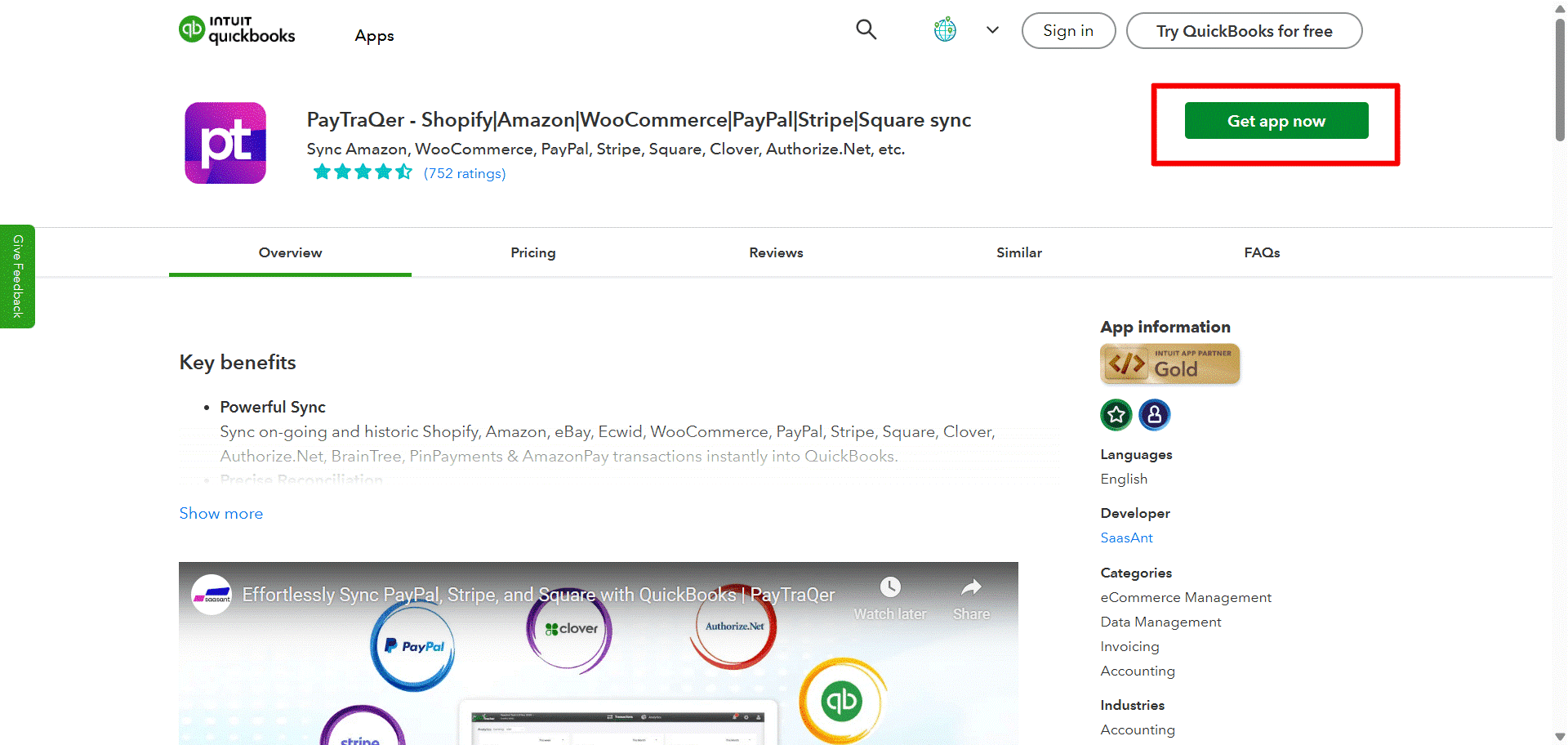

Step 1: Install PayTraQer from the QuickBooks App Store

Sign in to your QuickBooks Online account.

Go to the Apps menu on the left side.

Look for PayTraQer and click on Get App Now.

Follow the instructions to authorize and permit PayTraQer to link with your QuickBooks company file.

Step 2: Launch PayTraQer and Complete Initial Setup

After installation, launch PayTraQer from the Apps menu.

Select your QuickBooks company and verify the access permissions.

PayTraQer will assist you with an initial onboarding process to establish your syncing preferences.

This helps PayTraQer to understand your recording and tracking requirements.

Step 3: Connect Your PayPal Seller Account to PayTraQer

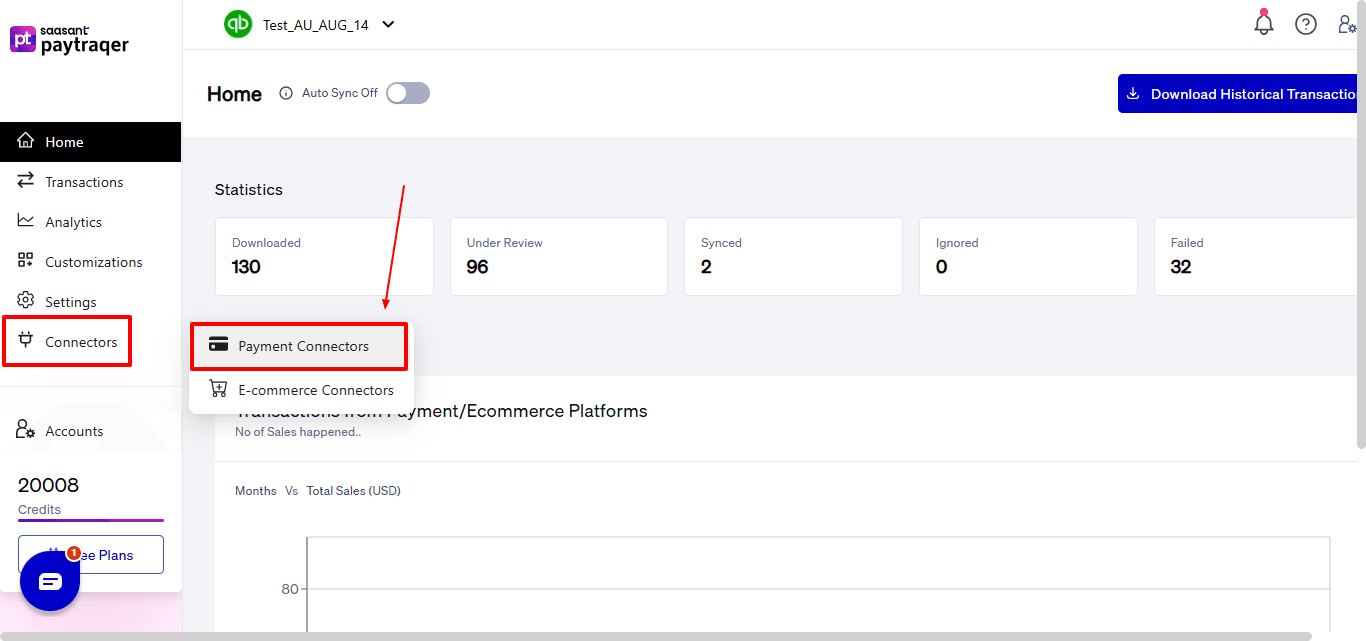

Select the “Connectors” option seen on the left side of the PayTraQer dashboard. Now, select “Payment Connectors” from the dropdown.

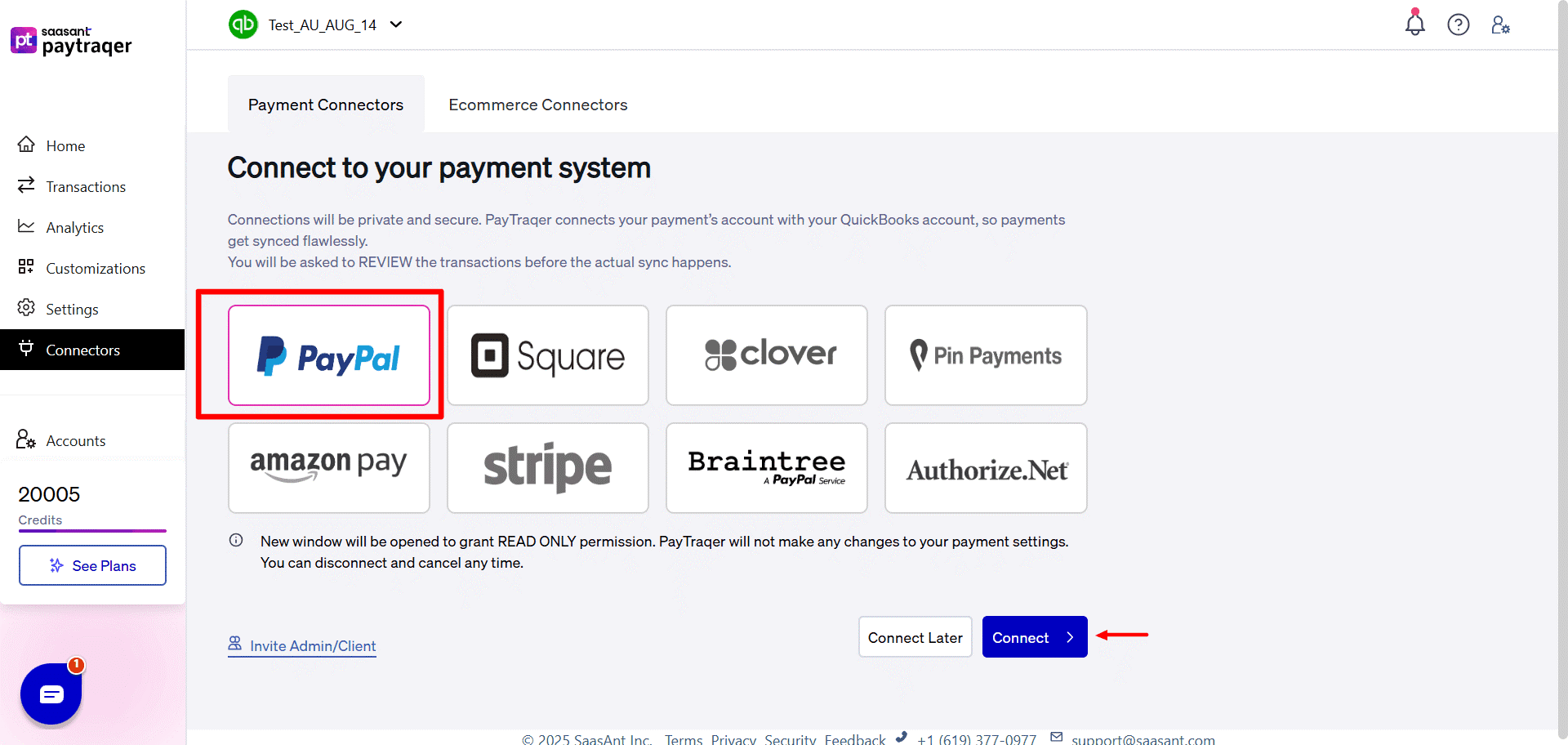

Choose PayPal from the list of supported payment and sales channels.

Choose one of the following methods based on your administrative access to PayPal:

If You Are the PayPal Admin:

Select the Connect button visible on the PayPal connector card.

Select “Proceed.” You will be redirected to the PayPal login interface.

You will be directed to the PayPal login interface.

Enter your PayPal admin email and password to sign in.

Pick the PayPal account that aligns with your business (if you have multiple accounts).

Click Connect to enable the link between PayPal and PayTracker.

You will automatically return to PayTracker to continue the setup process.

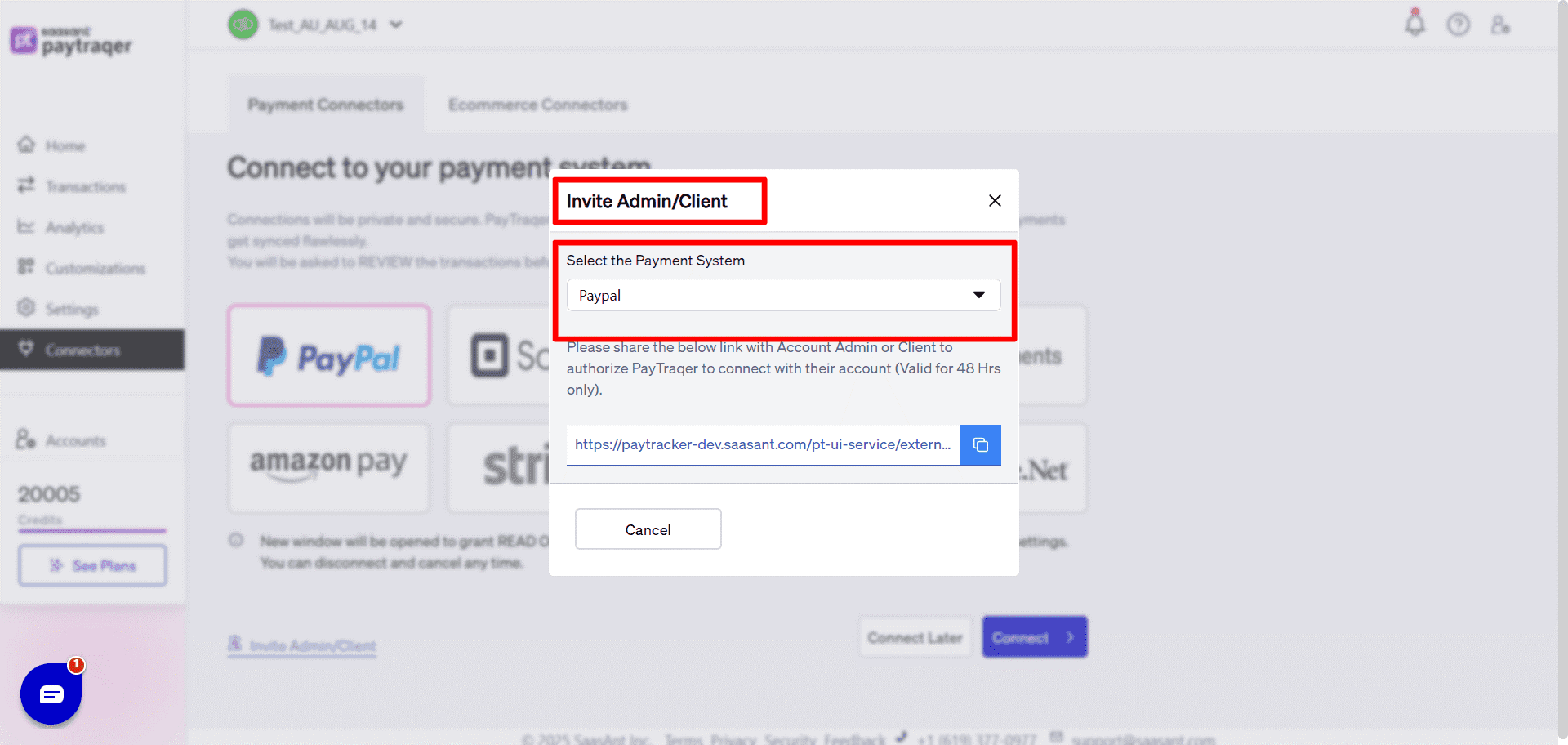

If You Are Not the PayPalAdmin:

Select Invite Admin or Client and choose PayPal from the available account authorization options.

Click on Get Invite Link to create a secure connection link.

Distribute the link to the account owner; they need to finalize the authorization.

The link remains valid for 48 hours, so make sure to confirm promptly.

Once the admin authorizes, access will sync back to PayTracker.

Once done, PayTraQer will link to your PayPal account successfully.

Step 4: Choose Your Data Sync Mode

PayTracker features two sync formats that specify how PayPal transactions will be documented in QuickBooks:

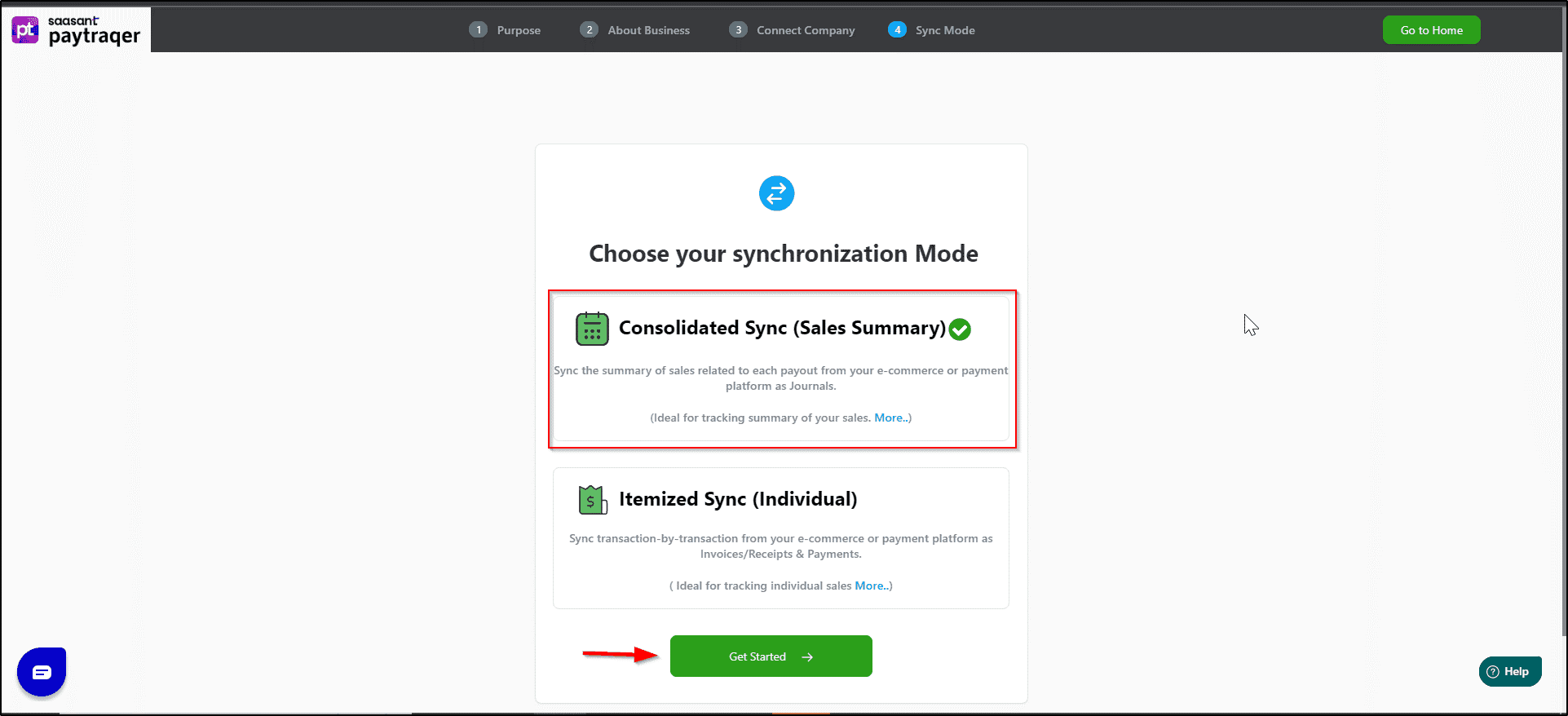

Option A: Consolidated Sync (Sales Summary)

Ideal for companies with significant daily or weekly transaction volumes.

Transactions are consolidated into summary entries instead of being listed as individual invoices or receipts.

Helps keep ledgers cleaner and decreases the transaction load within QuickBooks.

Enhances the speed of reconciliation as payouts and deposits align more predictably.

Option B: Itemized Sync (Individual Transaction Posting)

It is recommended if you need thorough line-level data for your reporting or recordkeeping needs.

Each transaction from PayPal is entered individually into QuickBooks.

Customer information, product details, tax information, and payment data are entirely traceable.

To continue:

Choose the sync mode that best represents how you wish the data to be displayed in QuickBooks.

Press Get Started to validate your selection and proceed.

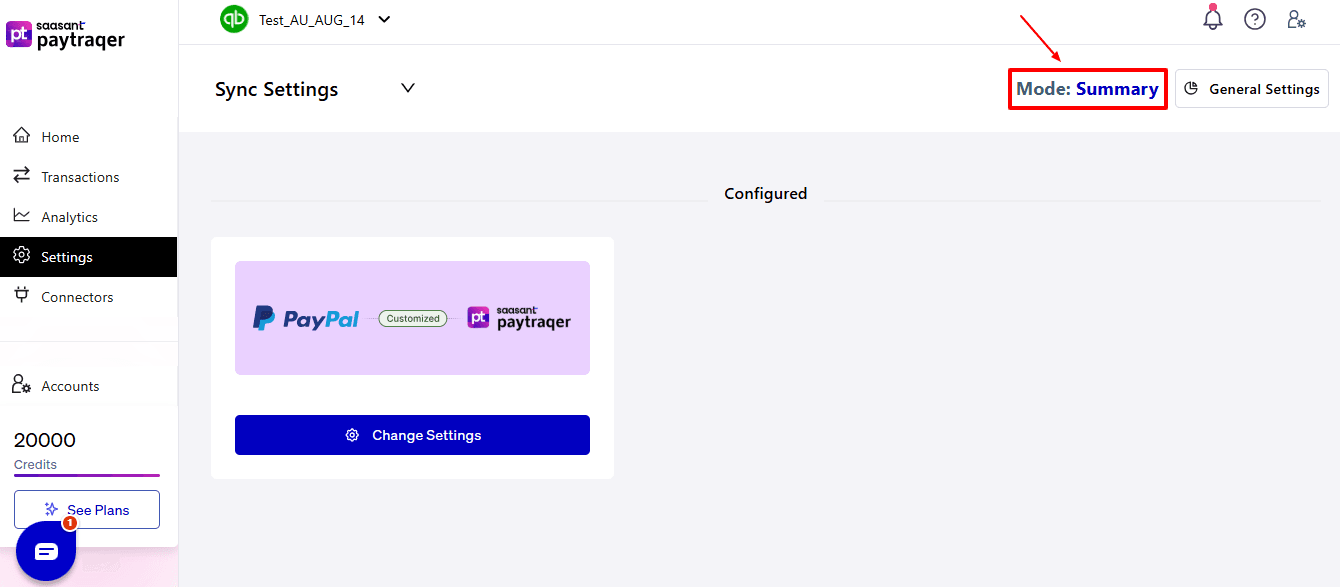

To modify your sync mode, click on the mode you wish to select, as indicated in the image below.

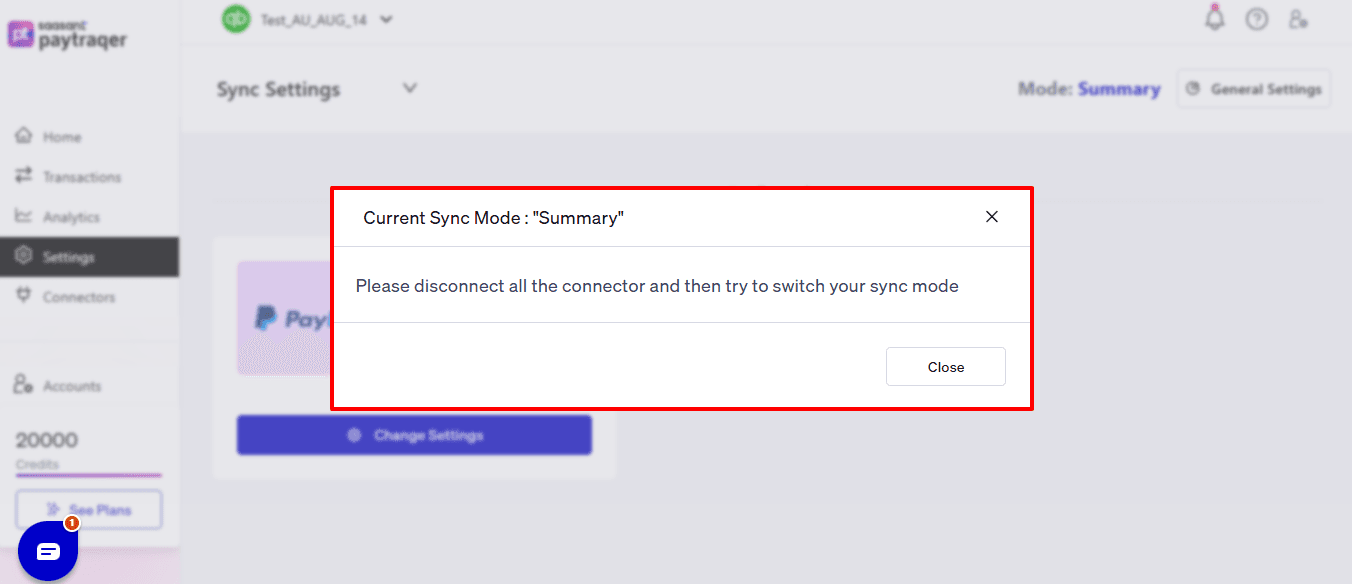

A pop-up will appear, asking you to disconnect the prior connectors before you can change the sync mode. You may proceed based on your preference.

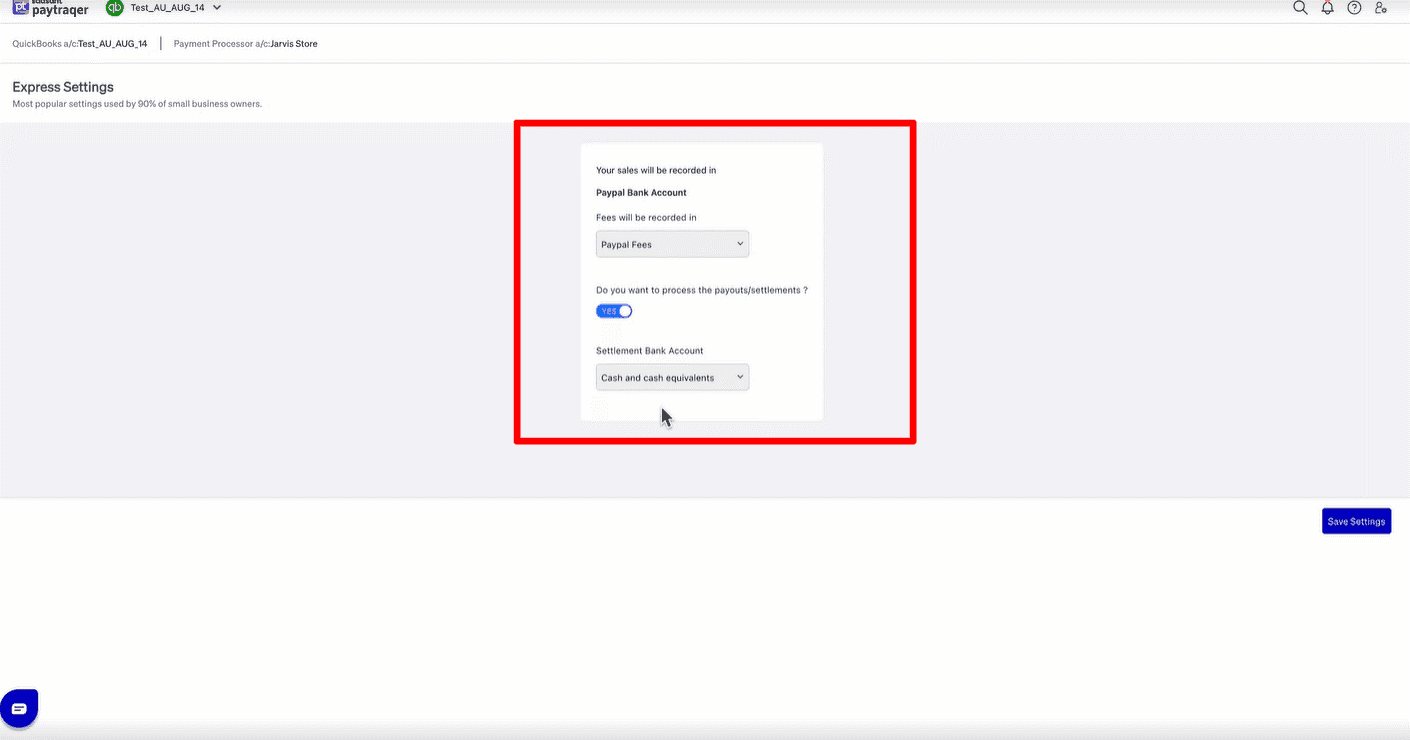

Step 5: Configure Posting and Settlement Preferences

After connecting to PayPal, PayTracker will request your accounting setup preferences:

Select whether PayTracker is to automatically process PayPal payouts and settlements.

Choose the bank account in QuickBooks that will record PayPal deposits.

Assign the income account for sales revenue (like Sales Income or Online Sales).

Assign the expense account for PayPal processing fees (for example, Merchant Fees).

Choose how PayTracker should match or create customer records:

Match by email

Match by name

Always create a new customer

Review the tax rate settings and decide how taxes should be mapped in QuickBooks.

After verifying all mappings and routing details, click Save Settings.

Step 6: Review Transactions Before Syncing to QuickBooks

The Transactions dashboard has various organizational views that assist in managing and checking your data flow:

Section | Purpose |

Review | Lists transactions that are ready for syncing. |

Synced | Includes transactions that have already been sent to QuickBooks. |

Error | List transactions that failed and need to be corrected. |

Ignore | Keeps track of transactions you deliberately avoided. |

Sync History | Provides a full timeline log of previous syncs. |

To review a transaction:

Select any transaction row in the Review tab.

Verify:

Customer name or match settings

Product or service item mapping

Revenue and fee accounts

Payment date accuracy

Tax treatment

Make modifications if needed.

Click Sync to forward the transaction to QuickBooks.

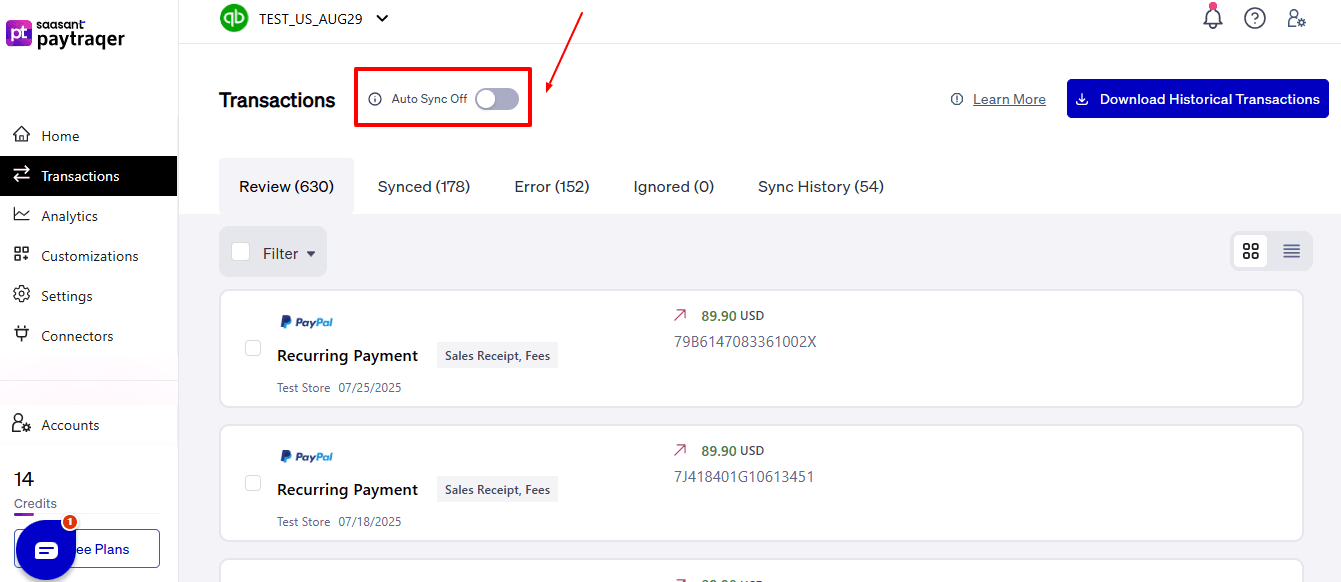

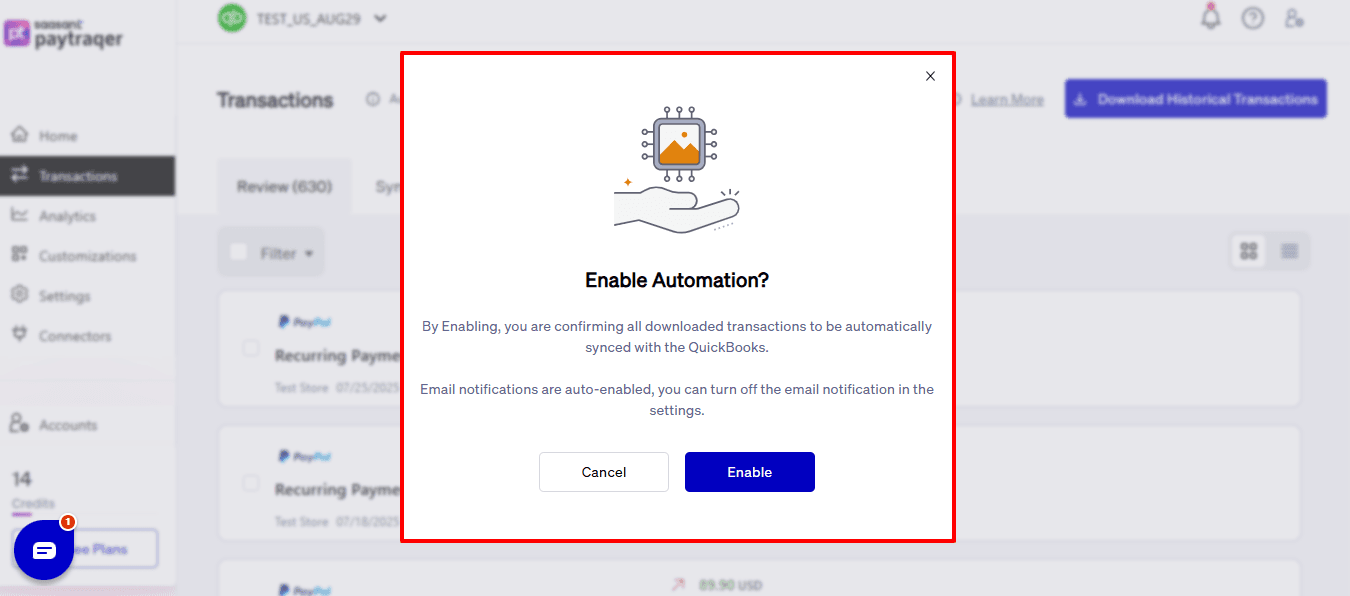

Step 7: Enable Auto-Sync (Optional but Recommended)

PayTraQer lets you manually sync your PayPal transactions whenever you want, giving you complete control over what is imported and when.

Auto Sync is set to off by default to permit a manual review of the first transactions.

Once you have validated that the mapping is correct and the entries are posting accurately:

Turn Auto Sync ON.

The automatic sync function ensures that PayPal transactions are always up to date, operating in the background according to your chosen schedule without needing any manual input.

PayTracker will then:

Automatically identify new PayPal transactions.

Implement your mapping rules.

Sync them into QuickBooks regularly.

Step 8: Download Recent PayPal Transactions

Select Download Transactions from the PayTracker dashboard.

PayTracker fetches transaction history from PayPal for the past 60 days.

Only finalized PayPal transactions are downloaded to avoid syncing any pending or incomplete charges.

Once the download is complete, the transactions will be listed in the Transactions section for your review.

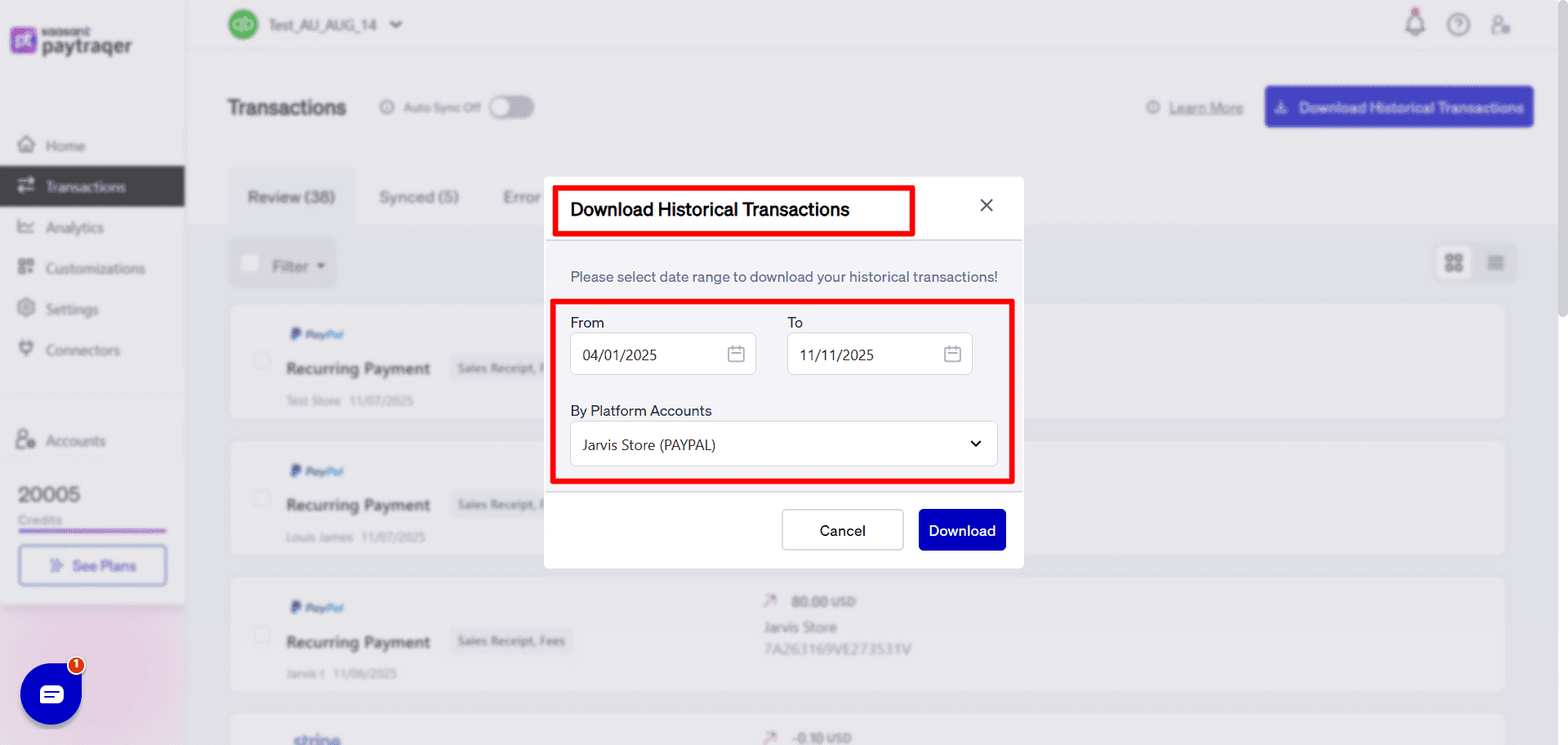

Step 9: Download Historical PayPal Transactions

Once your settings have been configured:

Proceed to the Transactions screen in PayTraQer.

Click on Download Historical Transactions.

Choose the date range for your previous PayPal orders.

Download the information. PayTraQer will showcase these records in the Review tab.

Inspect a few sample transactions, then select and click Sync to send them to QuickBooks.

Start with smaller ranges for testing, then use larger ranges when you feel ready.

Why PayTraQer is the Best Choice for PayPal–QuickBooks Integration

When syncing PayPal with QuickBooks Online, both accuracy and automation play crucial roles. PayTraQer simplifies this task with its seamless integration, ensuring that every sale, fee, and refund is accurately recorded. Here’s why PayTraQer is the top choice for accountants, bookkeepers, and small business owners:

Real-Time Sync: PayTraQer connects PayPal transactions to QuickBooks Online in real-time. Every sale, refund, and fee is automatically refreshed to maintain the accuracy of your books.

Historical Data Import: Conveniently import past PayPal transactions to resolve accounting gaps and maintain uniform, complete financial records across months or even years, without the need for extensive manual entries.

Complete Transaction Mapping: PayTraQer ensures that all PayPal transaction categories, payments, deposits, fees, and refunds are assigned to the appropriate accounts in QuickBooks.

Automated Fee and Tax Monitoring: PayTraQer smartly detects PayPal fees, discounts, and taxes, categorizing them accurately to ensure full transparency regarding actual earnings and operational expenses.

Flexible Sync Settings: Customize transaction rules, mappings, and automation options to fit your distinct bookkeeping system, providing you with total control over how PayPal information is displayed in QuickBooks.

Wrap Up

Integrating PayPal with QuickBooks Online via PayTraQer is the easiest method to automate your financial data flow. It alleviates the need for manual data entry, reduces bookkeeping mistakes, and guarantees that your records remain accurate at all times. Whether you are monitoring sales, documenting fees, or handling refunds, PayTraQer accurately syncs every PayPal transaction into QuickBooks. This saves you hours of work and improves financial transparency for businesses of any size. By opting for PayTraQer, you acquire an effective, dependable, and secure automation solution that simplifies your accounting tasks and allows you to concentrate on expanding your business.

If you have inquiries regarding our products, features, trial, or pricing, or if you require a personalised demo, contact our team today. We are ready to help you find the ideal solution for your QuickBooks workflow.

Frequently Asked Questions

1) Can I import my old PayPal transactions into QuickBooks Online using PayTraQer?

Indeed, PayTraQer enables you to retrieve and sync historical PayPal transactions from any selected date range, assisting you in efficiently filling gaps in your accounting records.

2) Does PayTraQer record PayPal processing fees in QuickBooks Online?

Definitely. PayTraQer automatically records all PayPal processing fees and categorizes them under your chosen expense account in QuickBooks Online for accurate tracking of expenses.

3) Can I connect multiple PayPal accounts to one QuickBooks company file through PayTraQer?

Yes. With PayTraQer, you can connect and oversee various PayPal accounts under one QuickBooks Online company, making it easier for businesses with multiple PayPal accounts.

4) How frequently does PayTraQer sync PayPal transactions with QuickBooks Online?

PayTraQer has both manual and automatic sync features. When auto-sync is turned on, it updates PayPal transactions continuously based on your preferred schedule.

5) Can I review or edit PayPal transactions before syncing them to QuickBooks Online?

Yes. You have the option to review, alter, or disregard transactions in PayTraQer’s dashboard prior to syncing them with QuickBooks Online, ensuring you have total control over your data.